gambling winnings tax calculator illinois

600 or more if the amount is at least 300 times the wager the payer has the option to reduce the winnings by the wager 1200 or. Gambling Winnings Tax Illinois - Find the best online slots from the most reputable developers.

What Do Odds Of 200 Mean Usbettingreport Com

By the Illinois gaming board law if the gambler winning any of the amounts from gambling they should inform the federal income tax department and it is a legal formality.

. You must report all gambling winnings as Other Income on Form 1040 or Form 1040-SR use Schedule 1 Form 1040 PDF including winnings that arent reported on a Form. That means your winnings are taxed the same as your wages or salary. Illinois tax rate on sportsbook winnings.

Your gambling winnings are generally subject to a flat 24 tax. Online and retail sports betting is the newest form of gambling in Illinois. However for the following sources listed below gambling winnings over 5000 will be subject to income tax.

Gambling Winnings Tax Calculator Illinois - New Casino Games Every Month. Gambling Winnings Tax Calculator Illinois. For tax purposes however its the same as any other form.

Players should report winnings that are below. Gambling winnings tax calculator illinois. All the top rated slots.

In some cases the tax 25 is already deducted by the casino before you are paid your winning. Gambling Winnings Tax Calculator Illinois - Want To Play Slots Online Casino Game. Gambling Winnings Tax Calculator Illinois - Find the best online slots from the most reputable developers.

For example lets say you elected to. Federal tax rates range from 10 to 37 and gambling winnings can bump a person into a higher tax bracket. You should consult a tax professional to avoid any mistakes.

All slots are licensed in the US so you can play safely at regulated casinos in your state. Download Now to Win Free Coins. Gambling winnings are typically subject to a flat 24 tax.

However for the activities listed below winnings over 5000 will be subject to income tax withholding. If you score big you might even receive a Form W-2G reporting your winnings. Gambling Winnings Tax Calculator Illinois - Most Trusted Online Casinos for USA Players.

All slots are licensed in the US so you can play safely at regulated casinos in your. However you may include the gambling winnings in. Illinois Tax Rate On Gambling Winnings - New Casino Games Every Month.

For tax years ending on or after December 31 2019 you must pay Illinois Income Tax on Illinois gambling winnings including sports wagering winnings regardless of your residency. 4 agosto 2021. If you were an Illinois resident when the gambling winnings were earned you must pay Illinois Income Tax on the gambling winnings.

There is a 15. Sloto stars casino Read Review. Platinum Reels Casino Read Review.

Gambling winnings tax calculator illinois. And you must report the entire amount you receive each year on your tax return. The tax code requires institutions that offer gambling to issue Forms W-2G if you win.

Caesars Online Casino Game- Play Free Play Slots Play The Casino. Any lottery sweepstakes or. The payer must provide you with a Form W-2G if you win.

Irs Gambling Losses Audit Paladini Law

Illinois Gambling Winnings Tax Calculator Illinoisbet Com

How To Report Gambling Income And Losses On Your Tax Return Tacct Tax Blog

Tax Calculator Gambling Winnings Free To Use All States

Gambling Com Group Gambling Group Twitter

Filing Out Of State W 2g Form H R Block

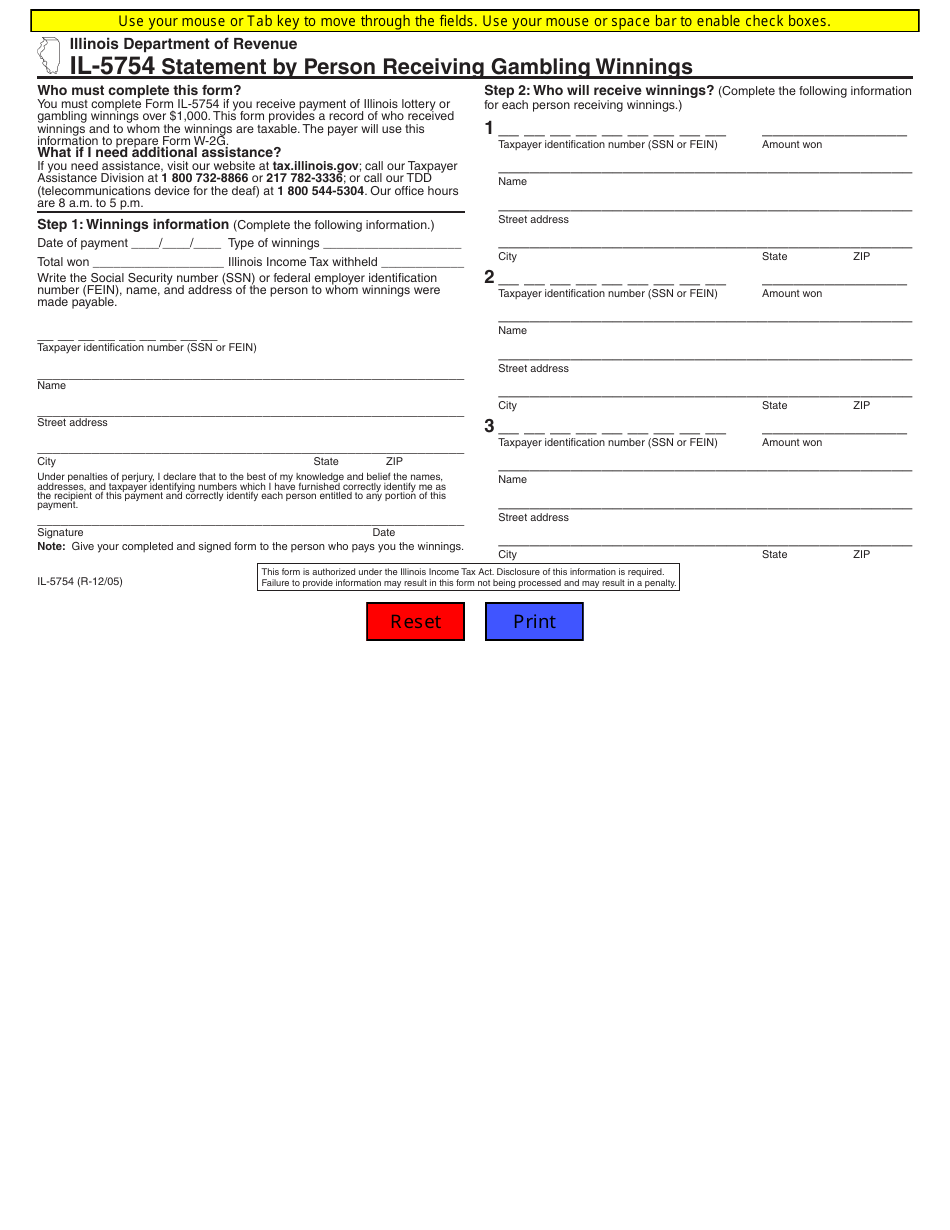

Form Il 5754 Download Fillable Pdf Or Fill Online Statement By Person Receiving Gambling Winnings Illinois Templateroller

What Are Legal Us Sportsbooks Really Paying In Taxes

How To Pay Taxes On Sports Betting Winnings Bookies Com

Free Gambling Winnings Tax Calculator All 50 Us States

Sports Betting Sites In Illinois Best Online Sports Betting In Illinois

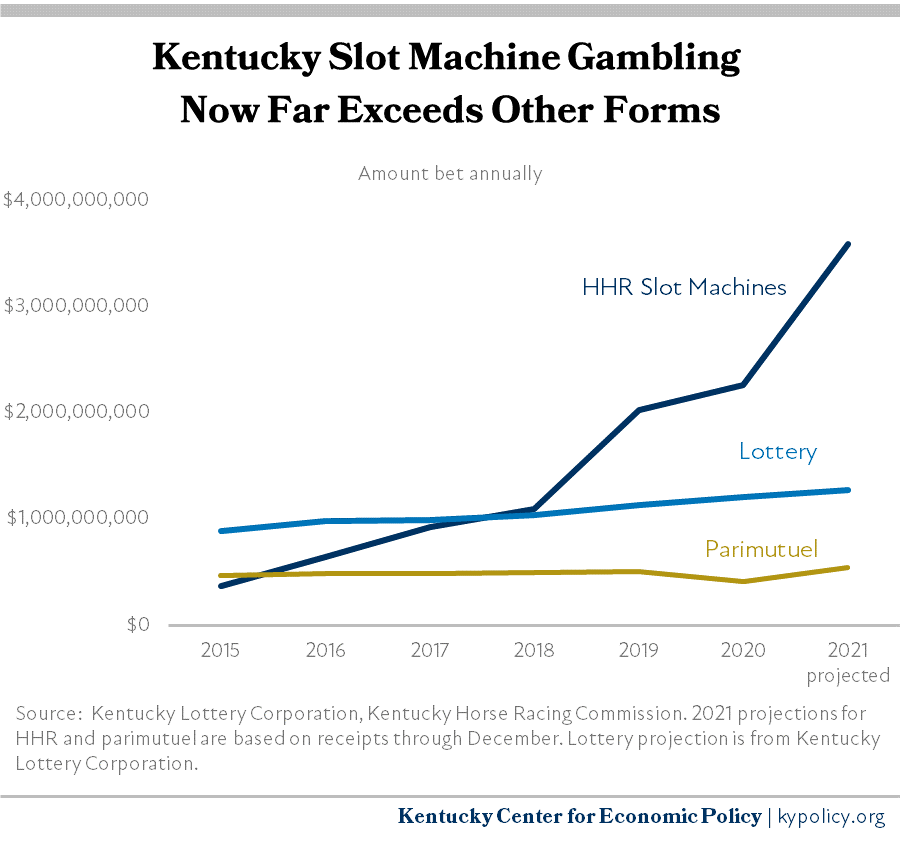

Coalition Letter To Kentucky General Assembly End The Tax Break On Slot Machines Kentucky Center For Economic Policy

Gambling Winnings Are Taxable Income On Your Tax Return

How To Report Illegal Gambling 8 Steps With Pictures Wikihow

How To Win Illinois Lottery Instant Games Freelotto Lotto Style Sweepstakes Spreadsheet Lottery Winning Numbers

Illinois Gambling Tax Il State Federal Gambling Taxes

Reporting Gambling Winnings And Losses To The Irs Las Vegas Direct